How to calculate the actual manufacturing cost?

- The shortcomings of micro-cost calculations in modern manufacturing.

- The phenomenon of product cost distortion in traditional cost accounting.

- The absorption costing of traditional cost accounting cannot handle the situation of idle capacity.

Accuracy and precision: If 6 or .7 is already incorrect data for 6.7345281, then what is the significance of .5281? - Robert S. Kaplan & Robin Cooper: COST & EFFECT (1998)

- In the 1990s, Robert S. Kaplan, an American accounting academic, promoted the Activity-Based Costing (ABC) method.

- In the 1960s, Germany adopted GPK (Grenzplankostenrechnung), which is the marginal costing accounting method.

- In 2003, the United States began implementing Resource Consumption Accounting (RCA).

Note: In the 1980s, Germany introduced an RCA-based cost accounting system with GPK as its foundational principle.

Paul Sharman: The biggest issue with ABC is its complexity and difficulty in integrating with IT systems. General feedback: ABC emphasizes the Activity View, while GPK focuses on the Resource View.

Activity Based Costing

| Data compilation |

|

| Cost settings |

|

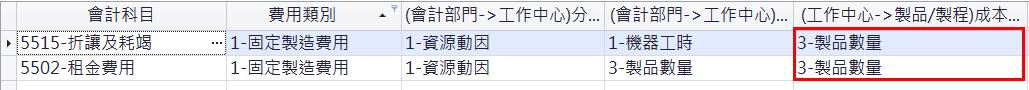

Setting the allocation basis for accounting categories corresponding to labor costs, fixed manufacturing expenses, and variable manufacturing expenses incurred during the production process

(Accounting department → Work centers)

Resource driver: Refers to the way and the reason resources are consumed by various activities. It is the fundamental basis for allocating resource costs to activities and is a factor that causes changes in operating costs. For example, in the case of electricity costs, if the cost increases as a result of longer machine hours for production, the allocation method can choose the machine hours as the resource driver.

Refers to costs with relatively fixed amounts that are periodically incurred, and the allocation basis comes from tangible factors such as the number of employees, floor area, and machine units used in production. These data can be easily calculated. For example, in the case of rent expenses, the floor area occupied by work centers can be used as the allocation basis.

Direct allocation refers to costs that are directly recognized and allocated to specific products. For example, mold expenses are directly allocated to the products that use those molds during the production process, or expenses related to outsourced processing are directly recognized on the outsourced products themselves.

- According to International Financial Reporting Standards (IFRS), if a company's actual capacity is lower than its normal capacity, any unallocated fixed manufacturing expenses should be recognized as the cost of goods sold.

- For example, if your fixed costs are $1,000, and the normal capacity is 100 hours, then your fixed cost per unit would be $10.

In this case, if your actual capacity is 50 hours, and your actual cost per unit is $20, while the normal unit cost is $10, you would need to recognize an excess capacity loss of $10 per unit. - This result occurs when lower production output or equipment idleness leads to an increase in fixed costs allocated per unit, and any unallocated fixed manufacturing expenses must also be recognized in the current period's cost of goods sold.

| Information communication between marketing and production |

|

| Monitoring of production progress and the production loads in the manufacturing process (work centers) |

|

| Control, audit, and decision-making information for the operational processes of the enterprise | |

Steps for Actual Cost Calculation

Cost setup operation for accounting categories - Fixed manufacturing costs corresponding to labor and overhead expense accounts.

Since the data for the resource driver is machine hours, which can be captured in the system with a weighted value of 1 for all work centers, there is no need to set it up here.

Executing the "Load Current Month Unallocated Data" button will calculate all the data on the cost allocation page.

- Amounts extracted from the financial module → Accounting categories + Department.

- Amounts by accounting category + department → Calculate labor costs, and fixed/variable manufacturing expenses by department.

- In-house receipt/transfer order → Extract machine/labor hours, quantity, and weight of production input and output for each work center.

- Machine/labor hours, quantity, and weight of production input and output for each work center → Calculate production hours, quantity, and weight by department.

- Amounts by accounting category + department → Detailed breakdown by accounting category + work center amounts → Labor and overhead costs for each work center (based on resource drivers set in accounting categories).

- Retrieve the normal capacity and hours for the work center, then calculate the fixed manufacturing costs for those accounting categories to determine the actual allocated fixed manufacturing cost amount.

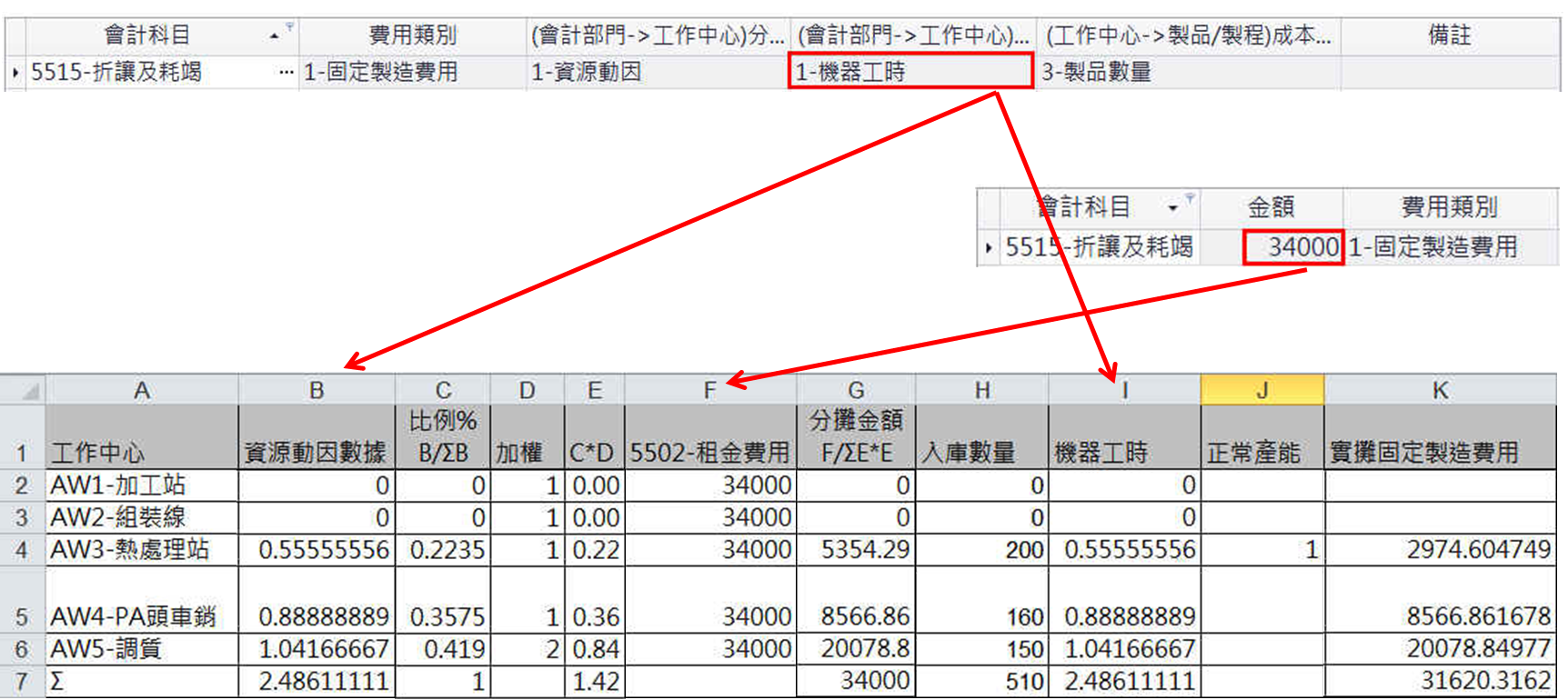

☑ 5502-Rent expenses: C1-data for each work center in Manufacturing Department 1.:

Note: Actual allocated fixed manufacturing costs for AW3=Allocation amount /Normal capacity hours→39216/1*0.555555555555556=21786.66667.

☑ 5515-Allowance and depletion: C1-data for each work center in Manufacturing Department 1.:

Note: Actual allocated fixed manufacturing costs for AW3 = Allocation amount / Normal capacity hours→5354.288549/1*0.555555555555556=2974.604749.

Execute the "Expense Allocation" button, and the system will allocate labor costs and manufacturing expenses for each work center to various products, calculating the labor costs and manufacturing expenses in the inventory receipt's manufacturing cost.

☑ 5502-Allocation of rent expense amount to C1: Manufacturing Department 1 for the production of manufactured products.:

Fixed manufacturing costs for product E=

5502-Actual allocated fixed manufacturing costs for rent expenses: 21786.6666666667/AW3 Total incoming quantity: 200*Incoming quantity for product E=10893.3333.

☑ 5515-Allocation of allowance and depletion amounts to C1: Manufacturing Department 1 for the production of manufactured products:

Fixed manufacturing costs for product E=

5515-Actual allocated fixed manufacturing costs for allowance and depletion: 2974.60474939393/Total incoming quantity for AW3: 200*Incoming quantity for product E=1478.302375.

Execute the "Cost Calculation" button, and the system will automatically calculate the weighted monthly cost starting from the lowest-level materials in inventory. It will also automatically update the total material cost of incoming orders that used this material at the previous level. Then, it will recursively calculate the material costs of semi-finished products and finished products at each level, along with the corresponding incoming orders.

- For products without inbound transfer orders, the system will use the weighted monthly inventory cost calculation formula, taking work-in-process inventory into account, to calculate the average unit cost. Subsequently, it will record the cost in the material cost details of the inbound order as the consumption cost.

- Weighted Monthly Cost = (Beginning Inventory Quantity x Average Cost from the Previous Month) + (Total Material Cost + Total Labor Cost + Total Fixed Manufacturing Cost + Total Variable Manufacturing Cost + Total Subcontracting Cost) + (Total Cost from Other Documents Affecting Costs This Month, i.e., Incoming Quantity - Returns + Beginning Inventory) + (Total Quantity from Other Documents Affecting Costs This Month).

☑ Explanation of the cost calculation process for product C:

First, calculate the average costs for the final materials C1 and C2, and then proceed with the cost calculation for each process of product C.

Previous Article

Previous Article