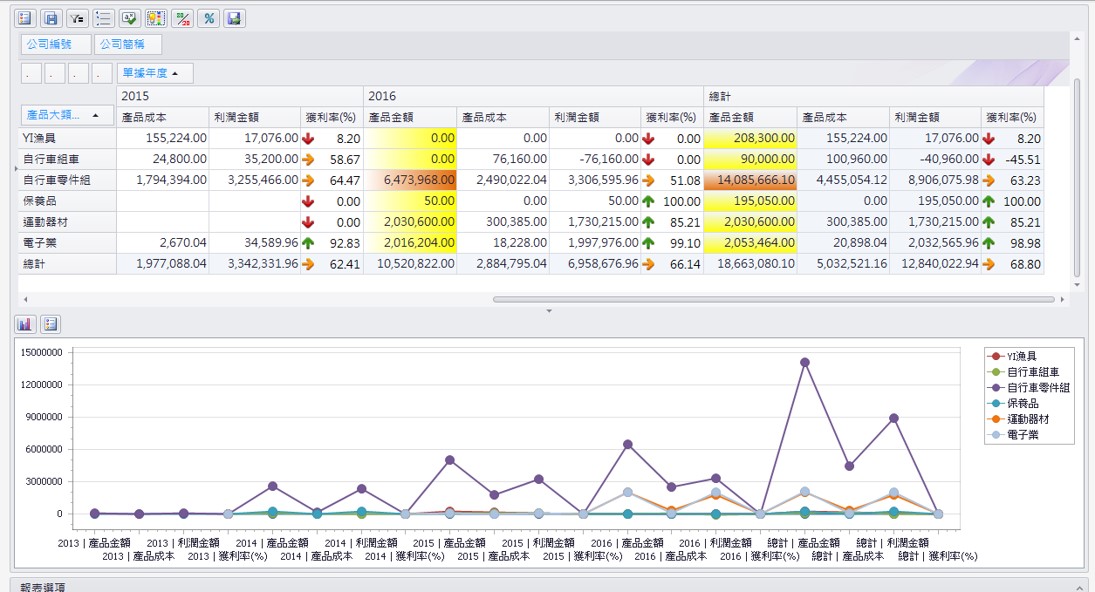

Problems with the Traditional Cost Accounting System.

Traditional cost accounting

Deficiencies in micro cost calculation in the modern manufacturing industry.

Product cost distortion phenomenon in traditional cost accounting.

Limitations of absorption costing accounting: Inability of the traditional cost accounting system to handle idle capacity.

Data organization |

|

Cost setting |

|

Cost setting for accounting items (ABC).

Setting the accounting items for the labor costs, fixed manufacturing overhead, and variable manufacturing overhead incurred in the product production process:

(Accounting Department → Work Center)

1. Resource driver: Refers to the way and reason resources are consumed by each operation, which is the factor causing changes in operation costs and the fundamental basis for allocating resource costs to operations.

For example, electricity costs; if the cost increases with longer machine working hours for product production, the resource driver, in this case, could be chosen as machine working hours.

The standard allocation resource driver data cannot be obtained from the ERP, so it must be set up in this operation.

Cost setting for accounting items (ABC).

2. Standard allocation: The cost amount for periodic consumption is relatively fixed and the allocation basis comes from tangible resources used in production, such as the number of employees, floor area, machine units, etc. These data can be easily calculated.

For example, rent expenses could be allocated based on the floor area occupied by the work center.

Cost setting for accounting items (ABC).

3. Direct allocation: Refers to the costs directly recognized on the products used.

For example, mold expenses are directly recognized in the production manufacturing process on the products that used the mold; or expenses incurred in outsourcing are directly recognized on the outsourced products.

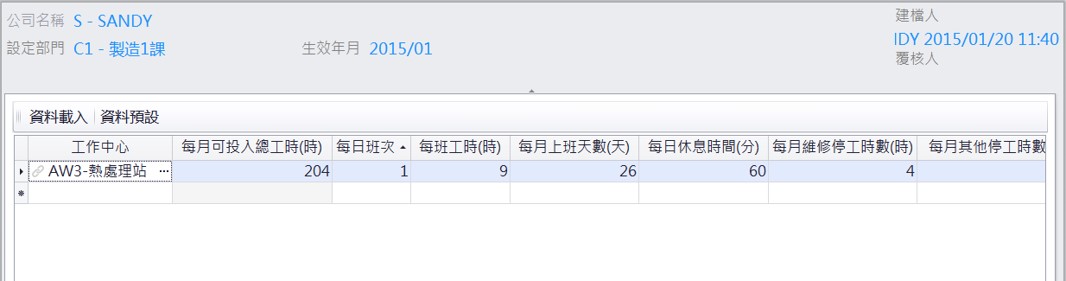

Normal capacity setting.

According to IFRS regulations: If the actual capacity of the company is lower than the normal capacity, the unallocated fixed manufacturing overhead should be recognized as the cost of goods sold.

For example, if your fixed cost is $1000, the normal capacity is 100 hours, then your fixed cost per unit is $10.

Now, if your actual capacity is 50 hours, the actual cost per unit is $20, and the normal cost per unit is $10, you need to recognize an unallocated excess loss of $10 per unit.

As a result, low production or idle equipment will increase the allocated fixed cost per unit, and the unallocated fixed manufacturing overhead must be recognized as the cost of goods sold in the current period.

Poor communication and disputes between departments, lack of precise information, delays in delivery, and production resource allocation.

Real-time monitoring of product progress at each stage and the production load information of each workstation.