Employees are valuable assets to a company, and excellent talents enhance its competitiveness. iTEC's HRM system effectively captures the distribution of human resources within the company, from organizational structure to the authority and responsibilities assigned to employees and the tasks they are responsible for. It assesses employees at every stage based on functional performance indicators, from application and probation to regular employment. HRM integrates comprehensive records of personal information, educational background, family background, professional skills, and more, incorporating them into talent selection, cultivation, retention, and perception, and preventing talent loss, thereby strengthening the suitability and application of talents.

| Selection | HRM system assists in assessing the suitability of individuals based on whether their talent characteristics align with the needs of the company and whether they are a good fit. |

|---|---|

| Staffing | Salary, bonus calculation, and employee performance evaluation can be divided into objective and subjective factors. The HRM system provides objective and measurable data to assess employee performance during each period. |

| Cultivation | In terms of employee learning and development, external or internal training is provided regularly each year, with the aim of precise training and effective learning to nurture talents within the company. The HRM system records the complete learning history of employees in the company's talent pool. |

| Retention | Establishing an HRM system in compliance with labor laws ensures that both employers and employees have a common standard to maintain the smooth operation of the company. |

| Perception | Employees can fully leverage their strengths when placed in the right positions, and the HRM system facilitates the display of their performance within their respective roles. |

The HRM system offers comprehensive personnel information management, including personal information, educational background, work experience, family background, skills, certification data, dependents, salary accounts... and more. It also allows for additional user-defined fields.

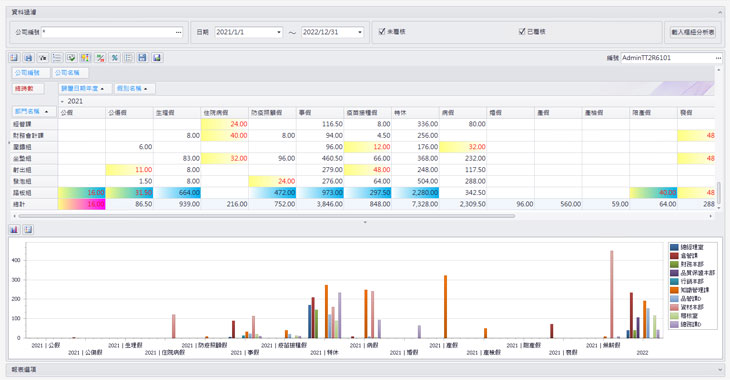

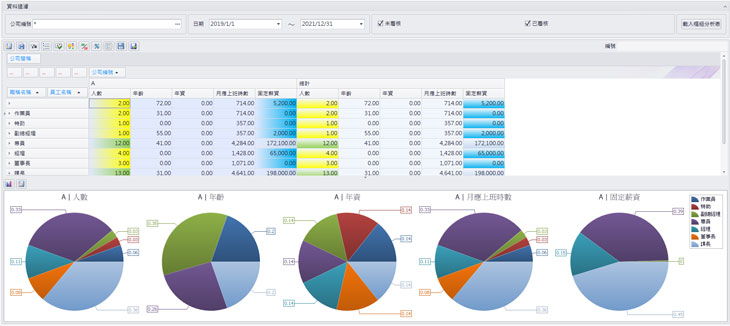

Additionally, it provides multi-dimensional statistical analysis reports for quick summarization and analysis of human resources data based on factors such as seniority, age, educational distribution, skills distribution, and a birthday overview.

The HRM system includes operations for labor insurance, national health insurance, and labor pension. It provides documents such as payment proof for labor insurance and national health insurance, a table of labor and national health insurance salary grades, an application form for labor pension withholding, records of annual employees' labor pension withholding, and income tax withholding forms. The standardized processes reduce manual errors and save time in making forms.

The HRM system allows for the detailed classification of employees' job grades and levels, enabling graded promotions. It facilitates seamless integration with salary adjustment operations, allowing for adjustments at one time. The system also provides a comprehensive recording of employee profiles and work history.

The HRM system provides a complete record of all changes in an employee's employment history from their start working date to the present, including probation to regular employment, leave without pay, reinstatement, job transfers, department transfers, attendance changes, salary adjustments, and more. Multiple hierarchical reports and analyses help reduce the difficulty of searching for information in the system.

The system automatically enhances the level of data security and implements controls that synchronize the effective date of employee departure with ERP account management, avoiding any administrative gaps.

For probationary and contract employees, when their contract period expires or licenses expire, the system automatically sends email notifications to the relevant personnel. It also allows flexible configuration to determine which individuals to notify and specify the timing of the notifications.

Based on the parameter settings of labor insurance and health insurance, the system provides a table for the allocation of labor insurance and health insurance amounts. For each employee, a list of dependents and the number of dependents is established. It provides an income tax withholding table, leave and attendance settings, and minimum wage settings, and integrates with salary calculations to automatically generate the applicable withholding amounts.

- Integrating the production reporting system and performing optimization scheduling simulations based on the limited resources of each unit.

- Enterprise human resources analysis directly converts invested human working hours into monthly output quantities, translating time into hourly production rates and costs. Based on the company's strategy, annual goals, and budgets are formulated and integrated with the budget management system.

- Following the implementation of the corporate strategy, departmental and individual key performance indicators (KPIs) are established, and data is integrated into the goal management system.

- Personnel changes can impact the data of various departments involved in production, sales, R&D, and finance. ERP document changes are generated based on personnel adjustments. For example, when an employee leaves the company, a complete transition is necessary to ensure a smooth job handover, thereby preventing any disruption in business operations.

- Integrating ERP accounts to prevent situations where employees have already left the company but their ERP accounts remain active or unchanged.

The setting of salary components with additions and deductions: Additions include base salary, attendance bonus, position allowance, meal allowance, overtime pay, etc. Deductions include attendance deductions, labor insurance premiums, health insurance premiums, supplementary premiums, income tax, welfare fund, etc. There is no limitation on the above items, and additional customized items can be added or removed as needed.

Once the attendance data is verified correctly, the system can quickly process payroll, supporting various salary calculation methods such as monthly salary, semi-monthly salary, hourly wage, and other calculation methods, including holiday bonuses, performance bonuses, etc.

In response to business flexibility, non-fixed salary bonuses can be disbursed separately or combined with regular salary payments.

Providing employee loan and repayment management to reduce the operational time for accounting personnel.

The system supports two methods of issuing individual pay slips: physical printing or sending encrypted PDF files via email.

Assessing the total salary cost for the new fiscal year, it can be integrated with the iTEC Goal Management module for analysis and use in annual budget management.

Automatically calculate the supplementary premium payable by individuals and company units, eliminating the need for accounting personnel to manually verify and reconcile them one by one.

Based on the parameter settings of labor insurance and health insurance, the system provides a table for the allocation of labor insurance and health insurance amounts. For each employee, a list of dependents and the number of dependents is established. It provides an income tax withholding table, leave and attendance settings, and minimum wage settings, and integrates with salary calculations to automatically generate the applicable withholding amounts.

All frameworks, including but not limited to leave and attendance settings, minimum wage settings, one fixed day off and one flexible rest day policy, calculations of second-generation National Health Insurance, individual income tax, etc., comply with legal regulations.

The system has built-in support for the salary calculation of employees in Mainland China, including the calculation of the five social insurance and one fund, as well as holiday pay calculations for festivals.

There are two modes of attendance, one using an office time clock and access control system, and the other utilizing a convenient mobile app for off-site employees to clock in. Systems can automatically import attendance data in both ways. In case of any abnormal attendance situations (such as lateness or absences), the system will immediately notify the respective department supervisors.

The system can perform statistical analysis and provide corrective measures when employees forget to clock in or miss clocking in.

By aligning with flexible scheduling settings for different periods, it breaks through resource limitations within the company and effectively utilizes the ERP system to enhance management efficiency.

The system includes two types of annual leave calculation methods: from the perspective of a calendar year or an annual year. With just one click, it can quickly, accurately, and efficiently calculate the annual leave for each employee. It also allows privileged personnel's annual leaves to surpass the requirements of the Labor Standards Act.

Based on the diverse competencies and management requirements of the company, it is possible to flexibly configure different shift schedules for certain employees.

Two annual leave calculation schemes are provided, from the perspective of a calendar year or an annual year. It enables accurate and quick calculation of annual leave for each employee. Additionally, it allows differentiation in annual leave between employees with privileges and regular employees.

To address the overtime issues arising from the production capacity requirements of various industries, the system allows flexible allocation of overtime pay or the option for compensatory leave during slack seasons. This helps to reduce costs and enhance production efficiency.

Unused annual leaves can be converted into salary payments or postponed to the following year.

The annual year system is based on an employee's start working date, where they are entitled to a full vacation after completing one year of working, following the legal standards. While the calculation basis varies for each employee, it can be administratively intricate. However, the calculation method is clear, reducing the likelihood of disputes between employers and employees.

The calendar year system calculates based on two periods within the fiscal year: the first period is from January 1st until an employee's start working date, and the second period is from the employee's start working date until December 31st. These two periods are proportionally calculated and summed to determine the employee's annual leaves for that year. Having a uniform starting date for all employees makes management easier and more convenient. However, there may be delays in granting leave and disputes between employers and employees regarding the calculation of days.