1. Compliance with accounting standards.

In addition to providing various financial reporting standards (GAAP/EAS/IFRS, etc.), iTEC ERP also allows flexible configuration and adjustment of account titles according to the internal management needs of each company.

When accounting entries and vouchers are recorded, they can be controlled based on the required accounting titles (department/cost center, object category, offset number, currency, debit/credit balance, etc.), thereby avoiding accounting errors and difficulties in auditing.

2. Compliance with local accounting tax acts.

Based on the localized accounting tax acts of different regions (Taiwan, Mainland China, Vietnam, etc.), iTEC ERP meets the specific accounting and tax operational requirements for each area. By utilizing OFFICE tools, ERP data can be exported to Excel spreadsheets or directly transformed into the required local tax regulation document formats using customizable reporting tools, which reduces redundant data entry, enhances work efficiency, and improves convenience.

3. Strengthening internal control and internal audit management.

After the information flow enters the financial end of the enterprise, it complies with internal control and internal audit to maintain accounting consistency. During the phased reform of enterprise management, flexible controls enable smooth progression from monthly closing to weekly closing and eventually to daily closing, achieving seamless upgrades without disruption.

Depending on each operational process during the reform, the authority control and responsibilities are set accordingly, implementing internal control and internal audit to prevent risks within the enterprise.

4. Compliance with the IFRS requirements.

The system provides a complete IFRS solution, including functional currency conversion, disclosure of operational department data, consolidated financial statements, real estate, revenue recognition, etc. Real-time access to financial data based on financial reports helps enterprises grasp their external competitive advantages and enhance their competitiveness.

5. Efficient Cost Settlement

The system covers both trading and manufacturing cost settlements, further improving ABC (Activity-Based Costing) operation cost settlement to enhance the accuracy of enterprise costs. For the subsequent annual budget submission, cost data can be detailed for each product, facilitating budget control.

6. Reinforcing the importance of cost management.

iTEC ERP costs can be categorized according to management needs: business cost, standard cost, batch cost, and average cost.

To reduce risks in enterprise management, the first step is to monitor profitability when accepting orders. The system establishes an effective cost-control process within the company based on external market price fluctuations.

7. Budget Management System

Based on annual sales forecasts, various resource demand analyses are conducted, and monthly expenditure costs are budgeted, including material costs, manufacturing expenses, outsourcing fees, and labor costs. The system generates monthly variance comparisons and analyses based on actual expenses and budgeted amounts.

8. Consolidated Financial Statements

The group accounts can be instantly consolidated without time-consuming data export and import operations, eliminating the drawbacks of traditional ERP multi-company and multi-database operations.

Various consolidation financial reports are provided to meet the needs of cross-regional and multinational enterprises, providing real-time and automatic consolidated financial report analysis at any time and at any location.

9. Automated Data Control

The system can adopt a subscription model, automatically generating real-time financial report data, enhancing management efficiency and accuracy.

10. Enhancing operational decision analysis data.

BI (Business Intelligence) tools are provided to meet various management financial reporting needs, primarily for forecasting, decision-making, planning, and control to address various business requirements.

11. Real Estate Management System

Multiple depreciation methods are provided, and depreciation can be automatically amortized monthly or yearly based on settings.

The system offers complete asset operations, including asset purchase, sales, scrapping, improvements, repairs, and maintenance, with automatic generation of real estate asset history tracking.

12. Financial Accounting Management System

The main functions include general ledger accounting, cash or petty cash management, bank management, bill management, real estate management, budget management, and foreign currency accounting management. Various financial report analyses can be conducted to control funds effectively.

The most important aspect is that documents generated from front-end operations, such as sales, inventory, accounts receivable and payable management, and other income and expense management, can be automatically transferred to journal vouchers, significantly simplifying accounting operations. This approach complies with standardization and internal control, enabling enterprises to shift from traditional manual operations to information-based operations.

Production Control and Cost Structure (BOM+BOP)

Related Cost Analysis

Material Cost

- Direct Materials

- Indirect Materials

Labor Cost

Direct Labor Wages

Manufacturing Overhead

- Fixed Manufacturing Overhead

- Variable Manufacturing Overhead

Freight Cost

- Inland Freight

- Sea Freight

- Air Freight

Export Cost

- Customs Clearance Fees

- Port Dues

- Visa Fees

- Bill of Lading Fees

Customer Complaint Cost

- Claim Amounts

- Rework Cost

- Replenishment Cost and Management Cost

- Cost of Quality Nonconformance

Other Expenses

- Miscellaneous Expenses

- Bank Transaction Fees

- Commission Expenses

Enterprise Management Forecasting, Decision-making, Planning, and Control

iTEC ERP provides essential information for business decision-making, enhancing enterprise responsiveness and preventing operational risks.

✅Maintaining stable revenue growth.

✅Properly controlling costs and expenses.

✅Persistently investing in the future.

✅Dedicating efforts to earn profits in the core business.

✅Focusing on improving Return on Equity (ROE) for shareholders.

Measuring business performance based on asset quality.

- Using the percentage of current assets to total assets in the balance sheet, short-term and highly liquid short-term investments that are easily convertible and have low transaction costs are considered cash.

- Enterprises should have an adequate amount of cash to enhance operational stability. It is generally recommended for companies to maintain 2-3 months of operating funds even without any cash inflow to reduce the impact of sudden turnover issues.

- Avoid excessive pursuit of capital gains in short-term investments.

- Long-term investments should avoid non-core or high-risk investments. Non-core long-term investments require a larger amount of manpower for management, increasing management burden and risk of losses.

- Short-term investments primarily involve shares of listed companies with pledging. Other receivables are mainly related to lending to related parties for long-term stock investments, often unrelated to the core business.

- A healthy combination of real estate, plants, and equipment with a high ratio of productive equipment and a fast fixed asset turnover rate.

- The ratio of office equipment and other assets that do not contribute to profits is low, and there are no or very few idle assets. The depreciation rate is high. For example:

| High depreciation rate | |

| Buildings | 10-20 years (e.g., peers: 20-56 years) |

| Machinery and equipment | 2-5 years (e.g., peers: 3-11 years) |

| Office equipment | 3-5 years (e.g., peers: 1-9 years) |

| Intangible assets mainly include | goodwill, technology licensing fees, computer software development fees, and patents |

| Other assets mainly consist of | deposits and deferred income tax assets |

Ranked by the strength of debt repayment pressure:

| ➀Corporate bonds | If unable to repay investors upon maturity, the company will immediately face operational risks. |

| ➁Notes payable | If unable to exchange notes upon maturity, the company will immediately bounce a check. |

| ➂Bank loans | Once overdue, the bank will call for repayment. However, there is room for negotiation. |

| ➃Employee payables | There is more room for negotiation. |

| ➄Accounts payables | Can be negotiated in the short term or buy time using notes or telegraphic transfers. |

| ➅Others | Book estimate items such as deferred income tax liabilities have no immediate repayment pressure. |

- Accounts receivable: Mainly refers to the debt arising from the sale of goods or services to customers, in other words, the money that customers should pay but have not yet paid.

- Inventory: Relates to the business scope of the enterprise, including sold finished goods, materials, and supplies used in the production process or service provision, etc.

Examining the financial statements to assess a company's profitability.

Evaluating the company's business performance through data from the "Balance Sheet" or "Statement of Financial Position."

Assessing a company's profitability from the data in the "Income Statement" or "Profit and Loss Statement."

Assessing the cost incurred by a company from selling inventory or providing services from the financial statements.

Assessing the costs incurred by a company from selling inventory or providing services, including both material and labor costs, from the data in the "Cost of Goods Sold Statement."

Discover the secrets from the Cash Flow Statement!

iTEC ERP offers two options, namely the "Direct Method" or "Indirect Method," providing flexible choices.

|

"A positive operating cash flow" indicates that the company is making money from its operations. |

| "A negative investment cash flow" implies that the business is expanding, and as it grows, it earns more. |

|

"A negative operating cash flow" indicates that the company is losing money in its core business. |

| "A positive investment cash flow" means the company is generating profits by selling off assets. |

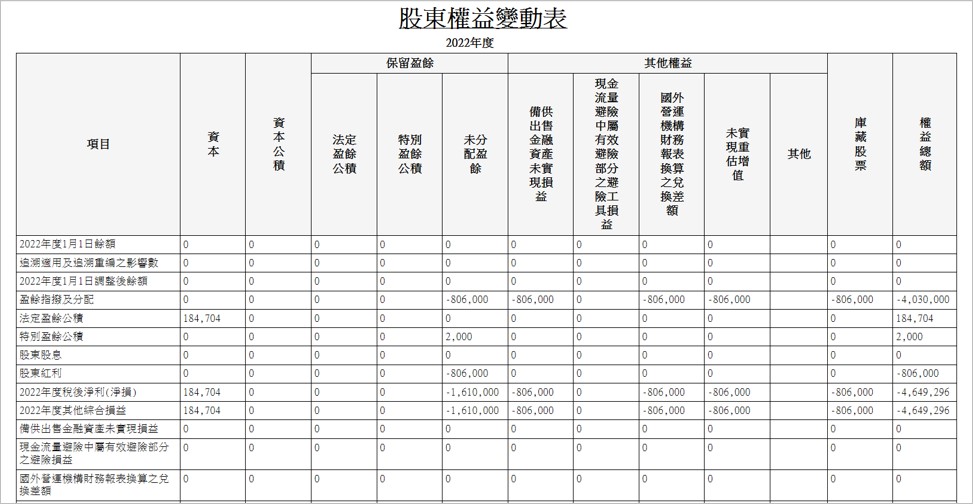

Examining changes in shareholder's equity from the financial statements.

Analyzing changes in shareholders' equity from the data in the "Statement of Changes in Shareholders' Equity".

Examining various indicators of a company's performance from the financial statements.

Analyzing changes in various financial indicators of a company from the data in the "Financial Ratio Analysis Table".

Common Financial Statements

iTEC ERP provides comprehensive financial statements, catering to various perspectives of financial reporting based on the size and requirements of the business organization.

- After creating journal vouchers on regular days, they are reviewed in the form of a voucher list to check for any missing vouchers that have not been posted. The system also records whether the vouchers are automatically generated or manually entered.

- Various types of journal vouchers can be analyzed based on debit and credit amounts for specific accounts, and statistical analysis can be performed from different perspectives, such as departments, parties, voucher numbers, project numbers, etc., to improve auditing efficiency.

- The system provides various financial reports for different perspectives, including individual companies, consolidated multi-company reports, multi-business group reports, multi-department reports, etc.

- By integrating transaction vouchers, accounting asset accounts, and budget accounts, the system generates detailed cash flow forecast analysis reports. These reports offer valuable insights for decision-makers in optimizing fund allocation and maximizing the efficiency of corporate funds.