ERP Knowledge Base

How to rapidly consolidate the financial accounts of multiple companies within a group?

How to solve the most challenging issue of consolidating financial accounts across multiple companies?

| ➀ Rework: After exporting from different databases, the financial statements cannot be merged automatically. |

| ➁ Unable to provide timely financial statements for business units and the corporate group. |

| ➂ It is necessary to re-transfer the financial data to the database and then merge the statements again when there is an error in a voucher. |

| ➃ Decentralized management: Independent databases and management issues. |

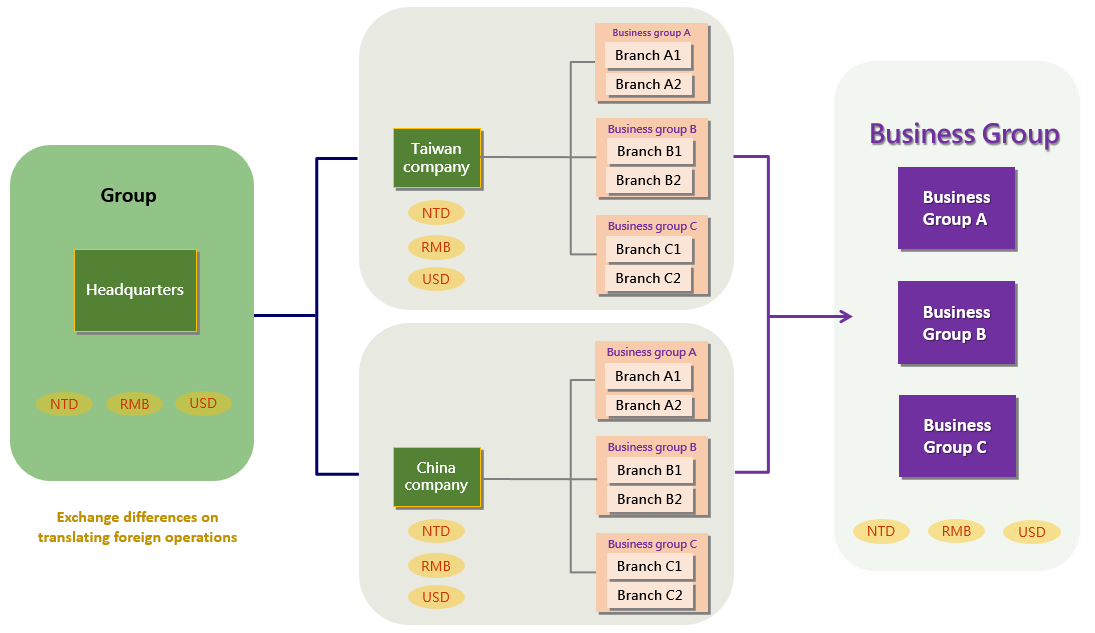

| ➄ Currency conversion: Providing financial statement conversion for business units and the corporate group. |

| ➅ Indirect consolidation: Providing financial statement consolidation for business units and the corporate group. |

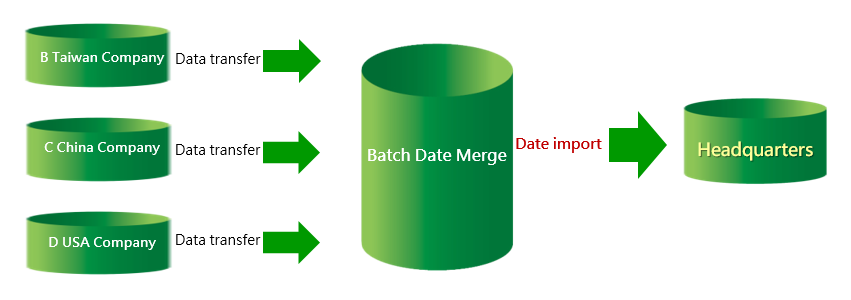

Traditional Accounting Integration

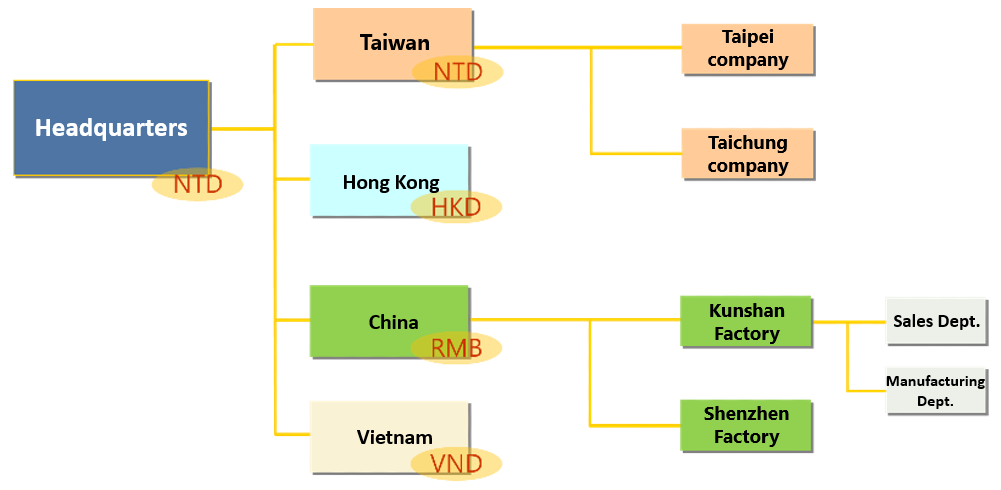

Multi-company multi-database operation

Multi-company multi-database operation

✖ Group accounts cannot be consolidated in real time.

✖ Data export, import, and merging take a long time.

✖ All users must exit and cease operations during data export and import.

✖ When subsidiary companies make adjustments, the group accounts must undergo export and import processes again.

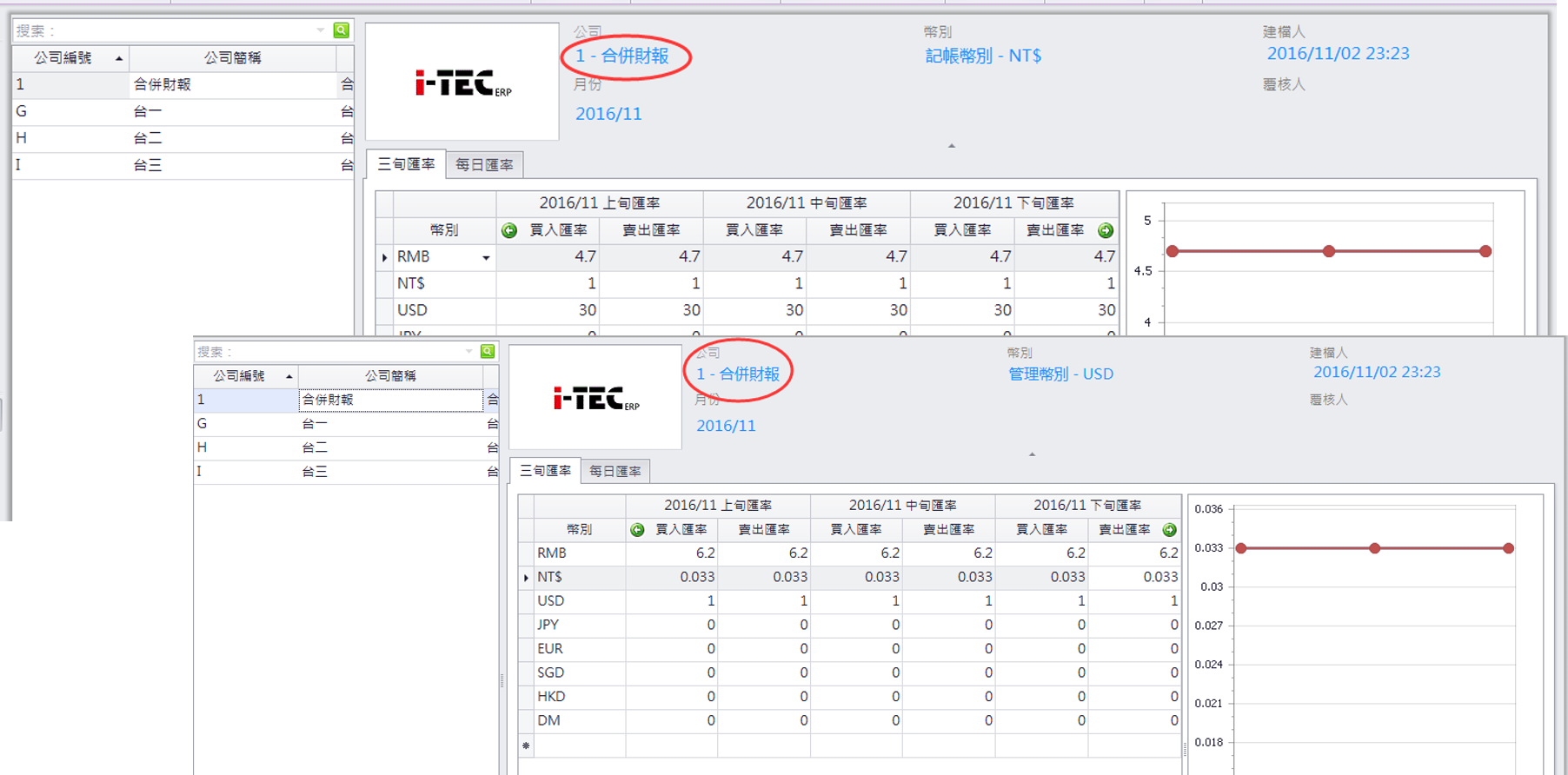

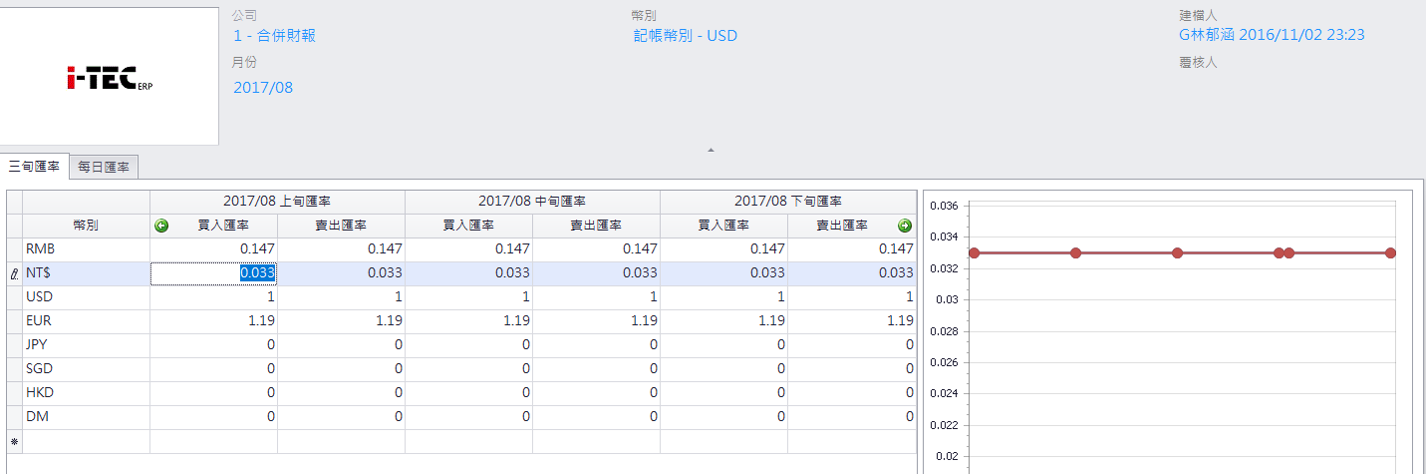

Exchange Rate Table Planning

Exchange rate discrepancies lead to errors in financial reporting. To mitigate this difference, a group exchange rate table is provided.

IFRS Module

- Inventory Revaluation

- Accounts Revaluation

- Asset Revaluation

- Foreign Currency Bank Deposit Revaluation

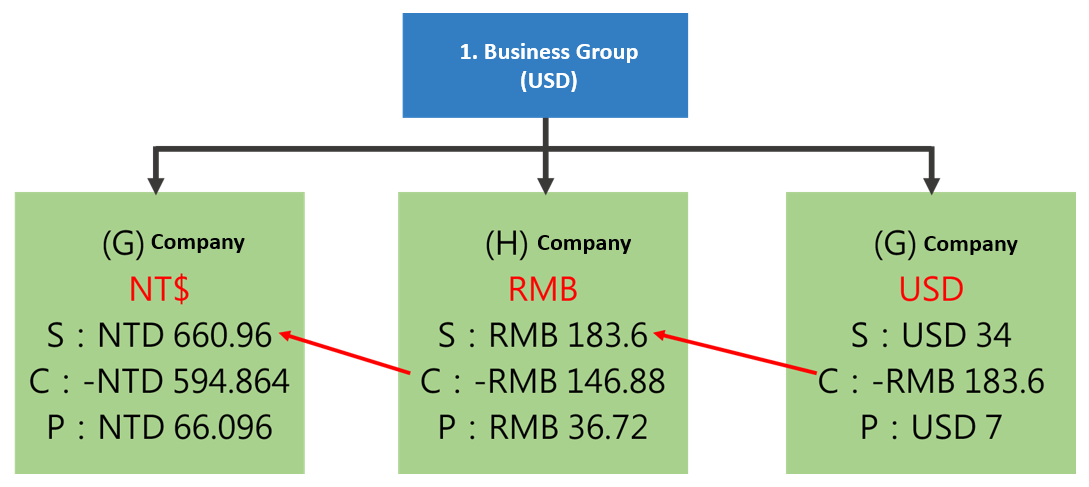

Group Case Illustration

Order Process

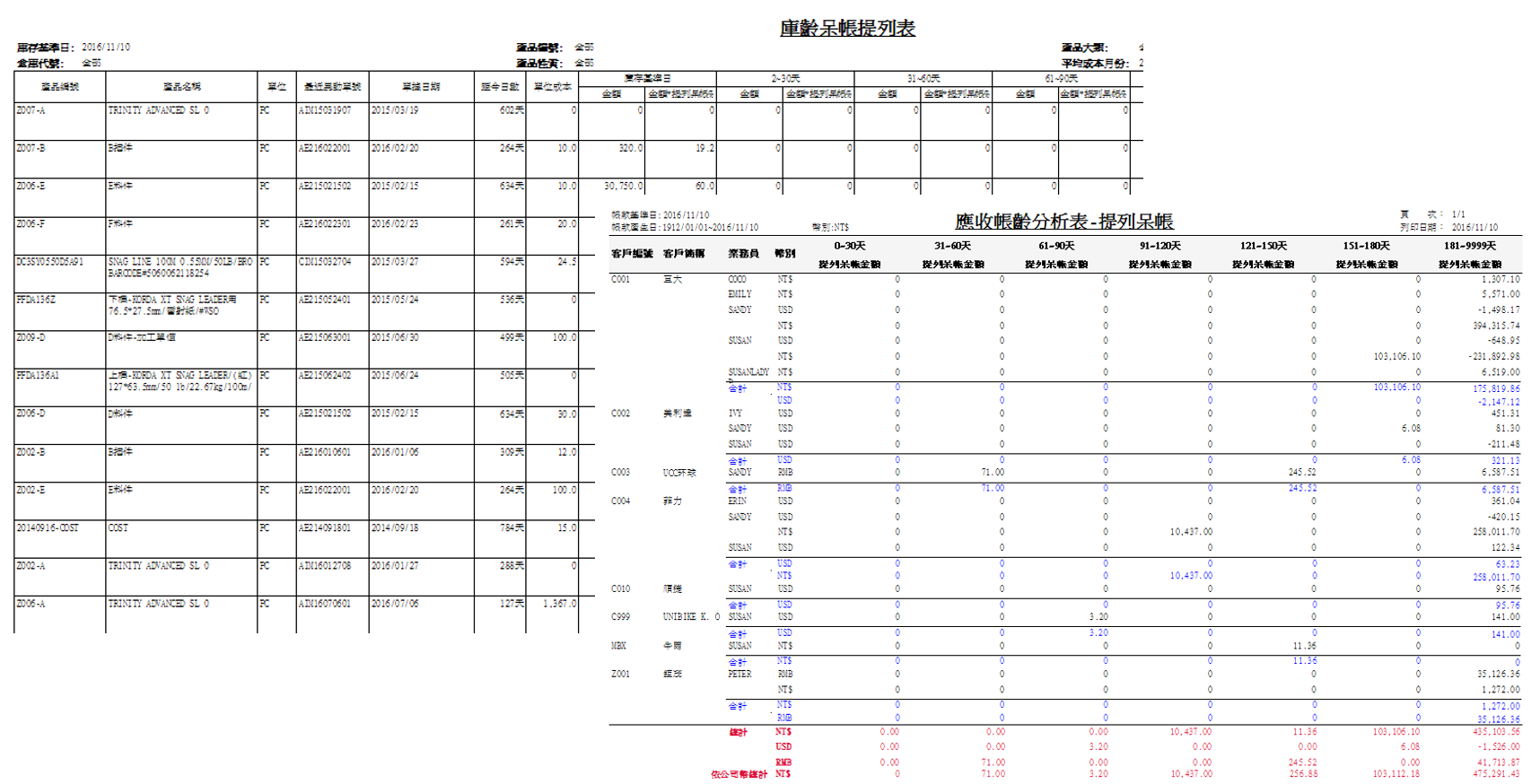

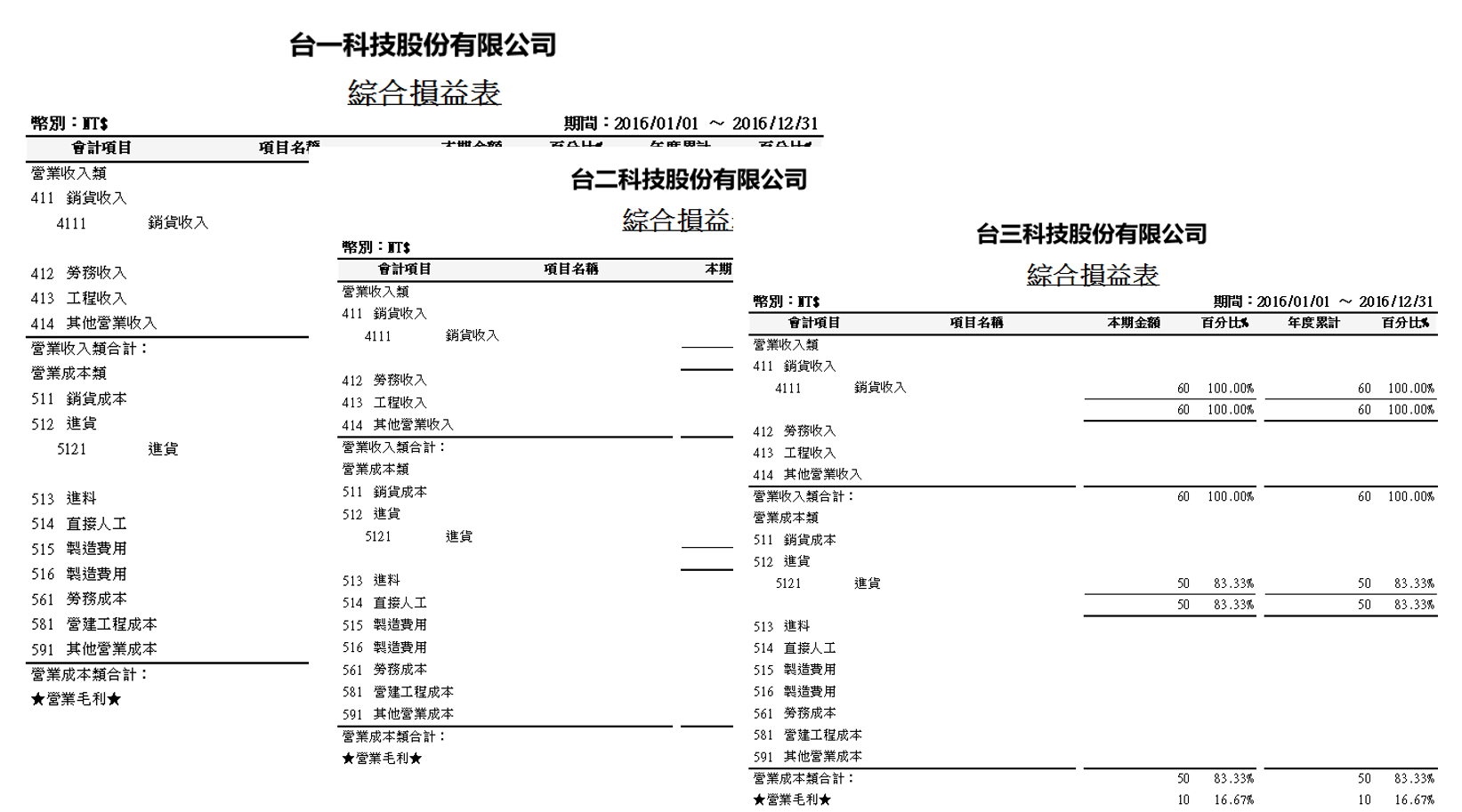

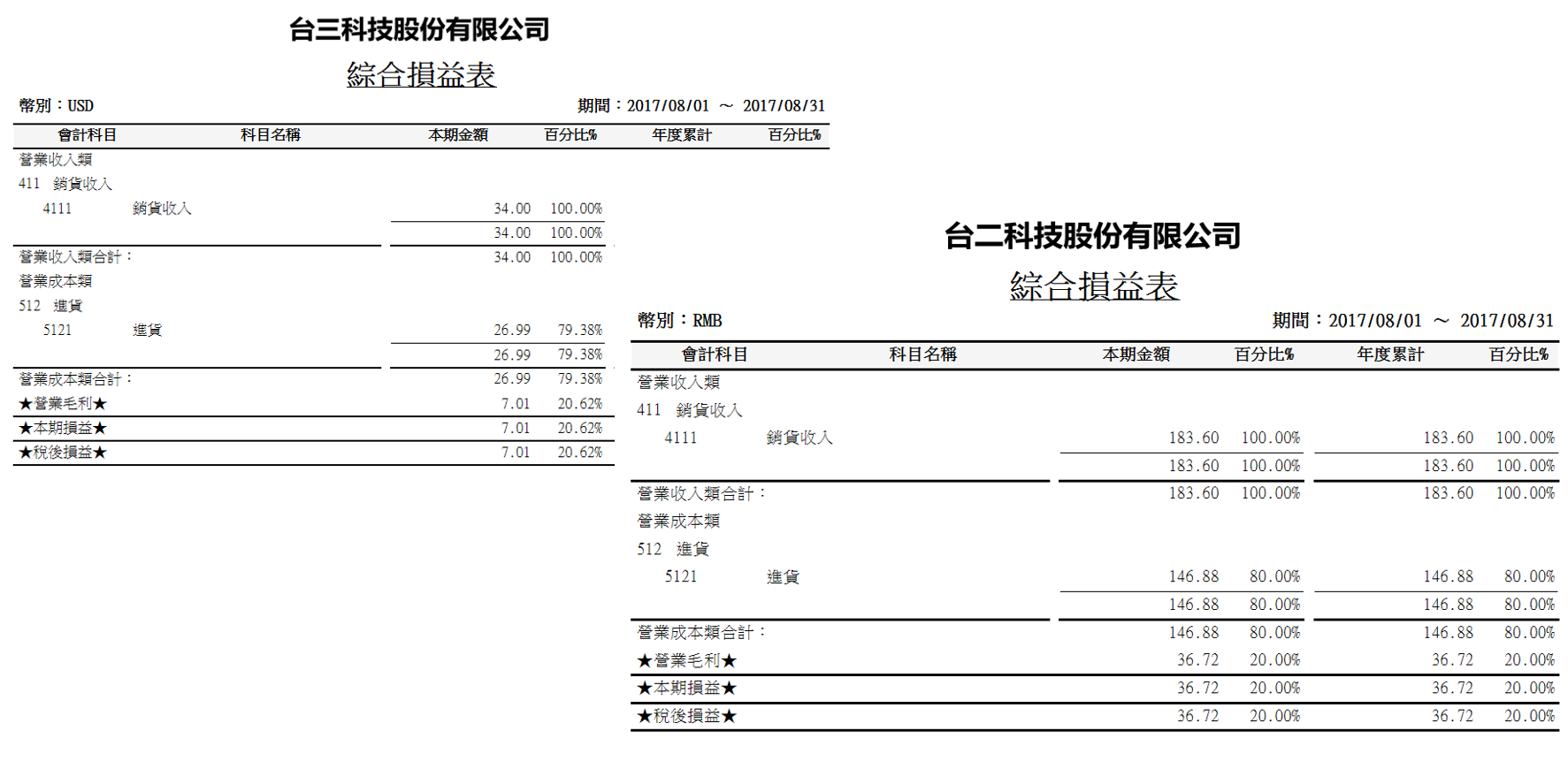

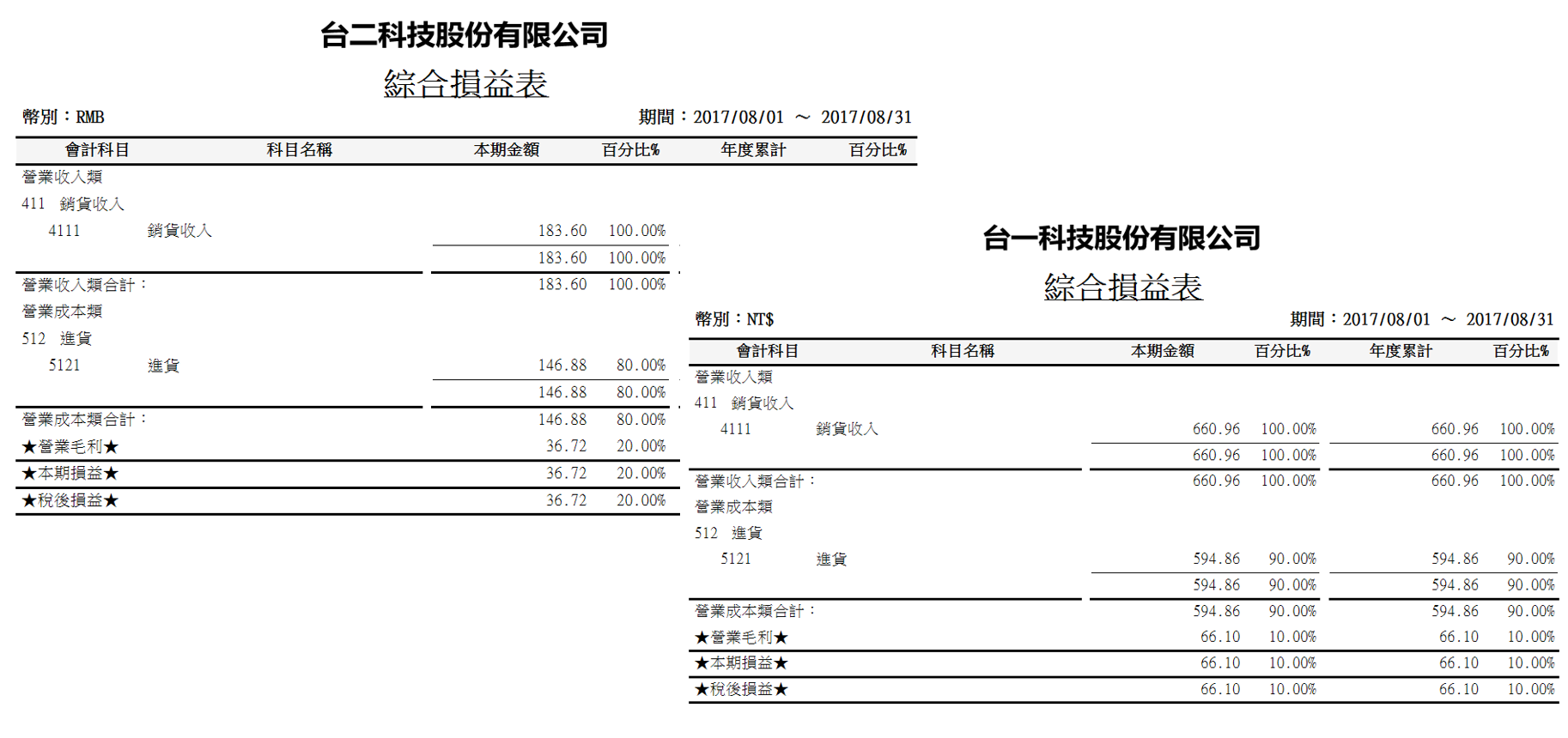

The profit and loss statement for each company is as follows:

- If customer A's order process is I → H → G, followed by direct shipment.

- If customer A places an order with (I) company for $34 for $27, then the hidden profit in (I) company is $7.

- When (I) company's purchase order is transferred to (H) company at USD 27, with a cost of RMB 146.88, and the hidden profit in (H) company is RMB 36.72.

- \When (H) company's purchase order is transferred to (G) company at a price of RMB 146.88 * 4.5 = NT$660.96, with a cost of NT$594.864, the hidden profit in (G) company is NT$66.096.

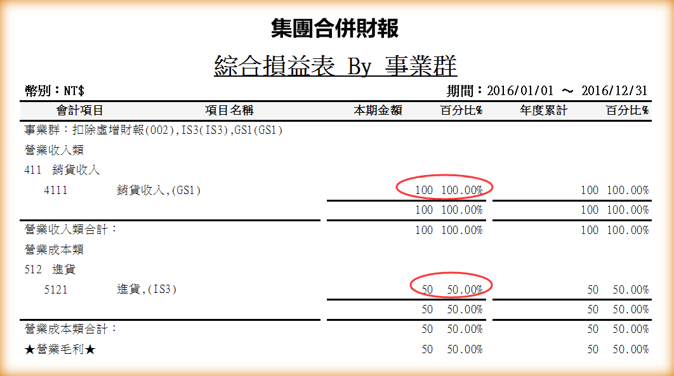

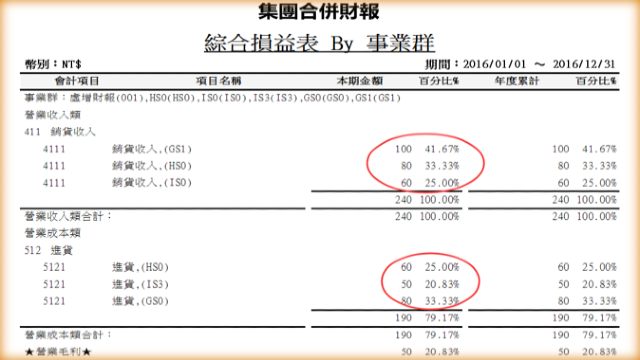

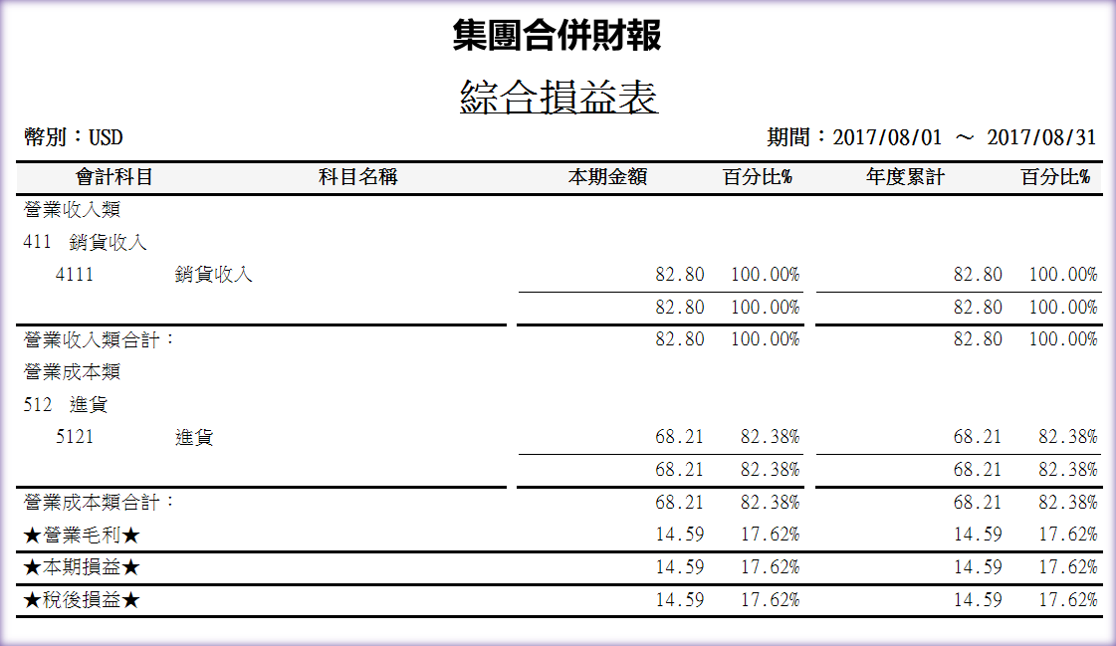

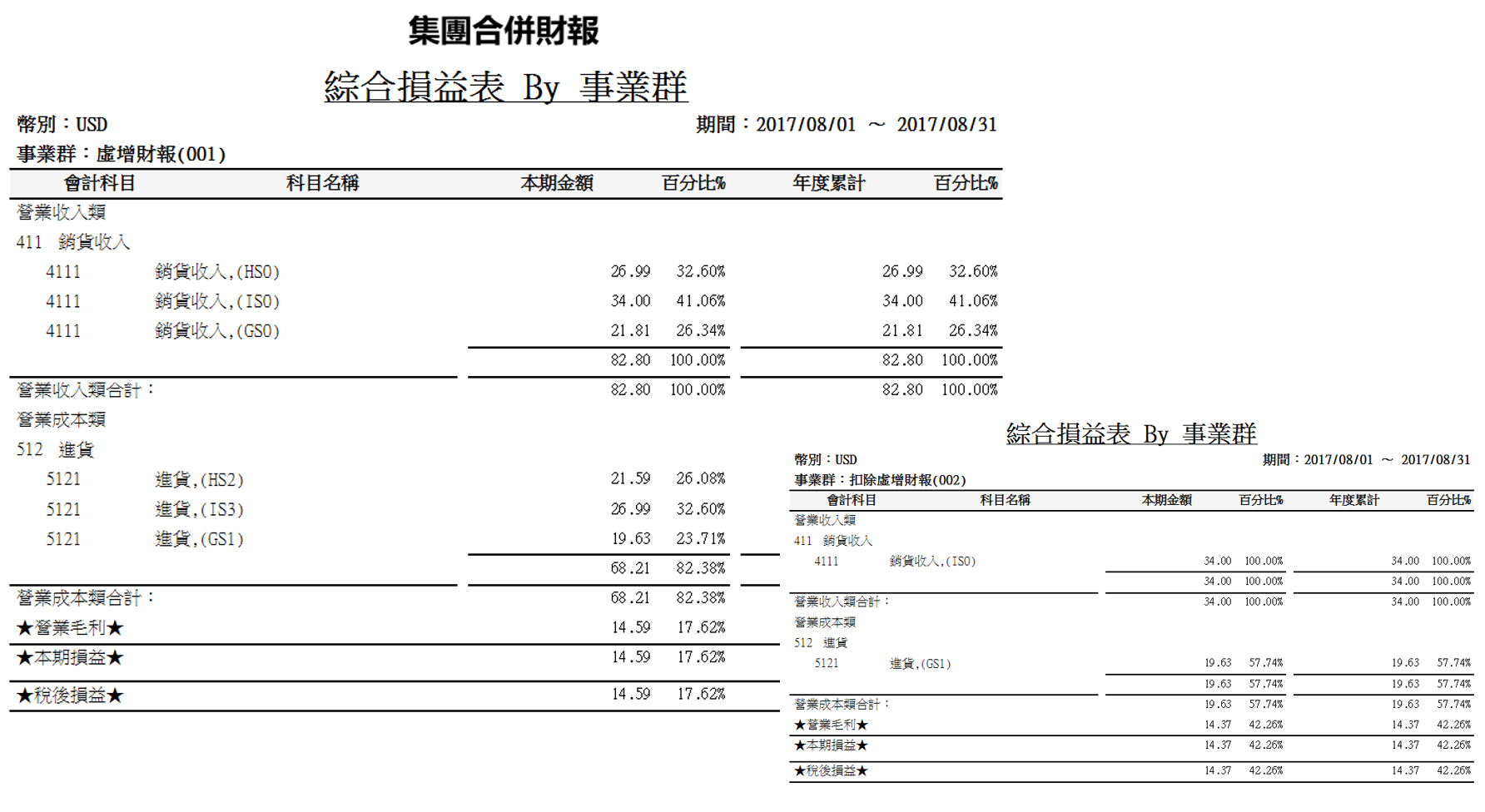

Group Consolidated Financial Statements

However, in the consolidated group financial statements, some figures are artificially inflated and need to be offset. As indicated above, all of these need to be offset, so there can be two ways to represent them in the group statements.

Financial Reports of Each Company

Related Information

How to manage frequent engineering changes (ECO/ECR/ECN) effectively?

ERP operational model in different industry?

How to manage complex and frequently changing materials?

Breaking News